nh meals tax change

NH Cuts Biz Rooms And Meals Taxes In 135B Budget. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

Pin On Favorite Fast Food Places Fast Food

To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

. That means someone buying a 24 restaurant meal would pay 12 cents less. Changes were made to the meals and rooms tax allocation formula that saw a smaller percentage going to towns and more money staying in the states general fund. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a New Hampshire Meals Tax Restaurant Tax.

NH Meals and Rooms tax decreasing by 05 starting Friday. Meals Rooms Tax Revenue Sharing 12. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

The budget cuts the 5 interest and dividends tax by one percent a year starting in 2023 and eliminating it by 2027 so that really doesnt affect this budget much. All meals and rooms tax licensees should implement the necessary changes to their systems to reflect this change by tomorrow. 125000 for married taxpayers filing separate.

According to the NH Lodging and Restaurant Association. If you have a substantive question or need assistance completing a form please contact Taxpayer Services at 603 230-5920. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety RSA 261.

This budget strengthens the New Hampshire Advantage once more. Another Favorite Author I Have Read All Of The Anna Pigeon Series Loved Them And Waiting For This One T Best Books To Read Worth Reading Stieg Larsson Books North Dakota Bismarck North Dakota Travel Nursing Bismarck North Dakota. The 2022-2023 budget set revenue.

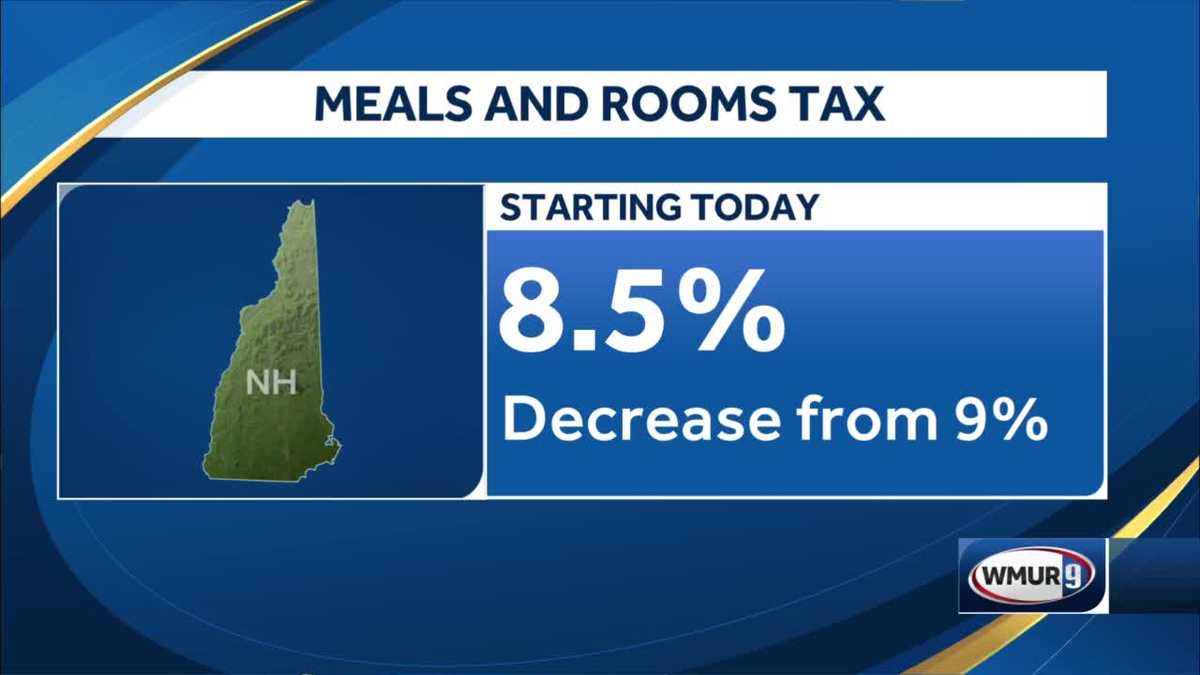

The House approved a bill that extends the rooms and meals tax to online platforms that coordinate private auto and short term rentals. Speaking of the rooms and meals tax the budget would cut that rate from 9 85 starting in January. A 9 tax is also assessed on motor vehicle rentals.

7 meals tax in North Andover and 9 in Salem not included. Law360 June 25 2021 704 PM EDT -- New Hampshires governor signed into law a two-year. The current tax on NH Rooms and Meals is currently 9.

Additional details on opening forms can be found here. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. Years ending on or after December 31 2027 NH ID rate is 0.

Years ending on or after December 31 2025 NH ID rate is 3. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check.

By law cities towns and unincorporated places in New Hampshire are supposed to get 40 of the meals and rooms tax revenue but that became less certain after the 2009 recession. Chris Sununu in this years budget package which passed state government in June. Multiply this amount by 09 9 and enter the result on Line 2.

Years ending on or after December 31 2026 NH ID rate is 2. Concord NH The. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax rate will decrease by 05 from 9 to 85.

New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax ratewill decrease by 05 from 9 to 85. NH Meals and Rooms Tax. 2022 New Hampshire state sales tax.

Starting Friday the states tax on rooms and meals was reduced from 9 to 85. The budget the State Legislature passed increases the meals and rooms tax from 8 percent to 9 percent effective July 1. A 9 tax is assessed upon patrons of hotels and restaurants on meals alcohol and rooms costing 36 or more.

File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85 For additional assistance please call the Department of Revenue Administration at 603 230-5920. The organizations has requested the. Bill supporters say it will level the playing field with brick and motor establishments that collect the levy and remit it to the state.

An additional 09 Medicare tax will be imposed on self-employment income in excess of 250000 for joint returns. The state meals and rooms tax is dropping from 9 to 85. There are however several specific taxes levied on particular services or products.

Nh meals tax change Tuesday March 8 2022 Edit. As a result of these changes more than 90 of the revenue raised by the BET will now go directly to the Education Trust Fund. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

A New Hampshire Meals Tax Restaurant Tax can only be obtained through an authorized government agency. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Exact tax amount may vary for different items.

New Hampshire careers in healthcare. For more information on motor vehicle fees please contact the. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85.

Years ending on or after December 31 2024 NH ID rate is 4. Advertisement Its a change that was proposed by Gov. AP Dining and staying overnight in New Hampshire just got a little bit less expensive.

This budget raises no new taxes or fees and is free of a sales or. New Hampshire is one of the few states with no statewide sales tax. Fillable PDF Document Number.

For Business And Private Events The Nh Cavalieri In Pisa Offers Three Multi Purpose Meeting Rooms Accommodating Up To Eighty People In A Modern And Relaxing A

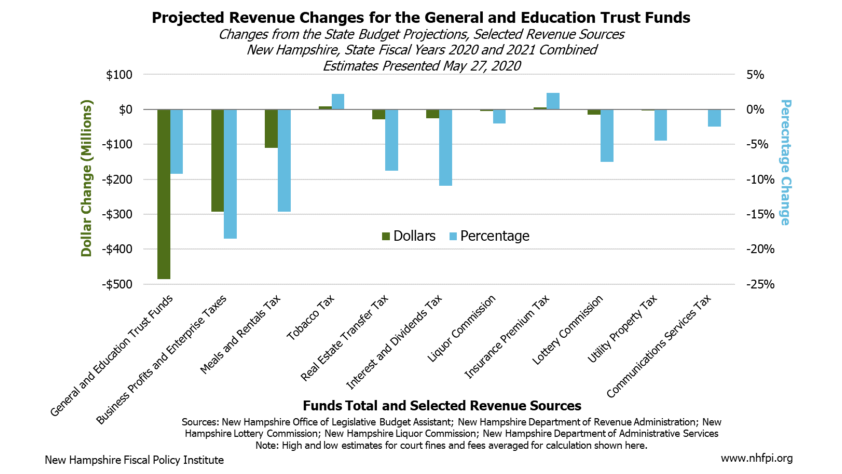

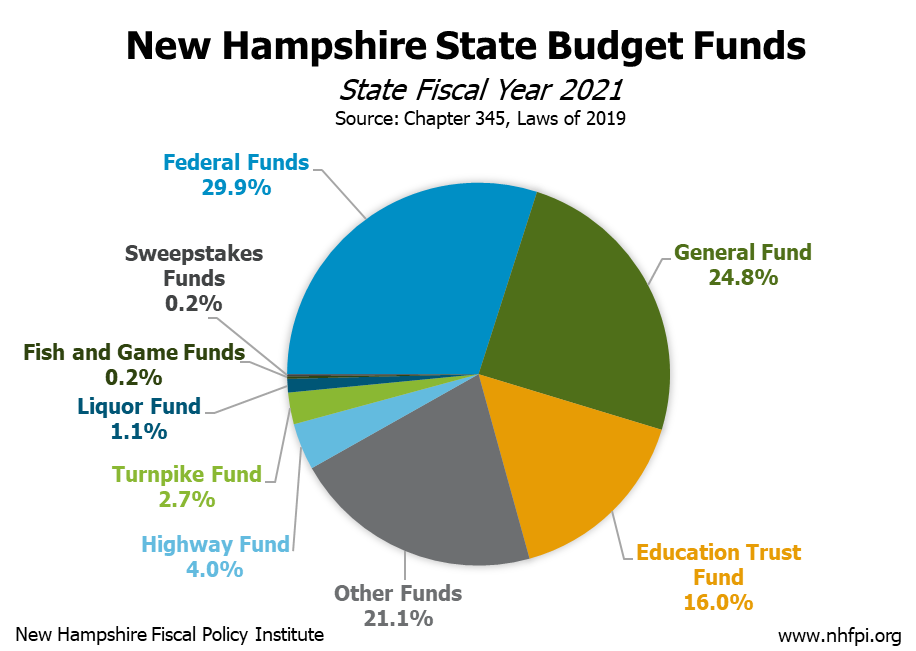

New Hampshire State Agencies Project Major Revenue Declines Nh Business Review

Historical New Hampshire Tax Policy Information Ballotpedia

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

Nh Fiscal Policy Institute Holds Panel To Address Food Insecurity

Thanksgiving Buffet At Woodlake Country Club On November 28th Celebrate Thanksgiving With Family And Frien Champagne Vinaigrette Fruit Display Antipasto Salad

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Meals And Rooms Tax Rate Cut Begins

Nh Fiscal Policy Institute Holds Panel To Address Food Insecurity

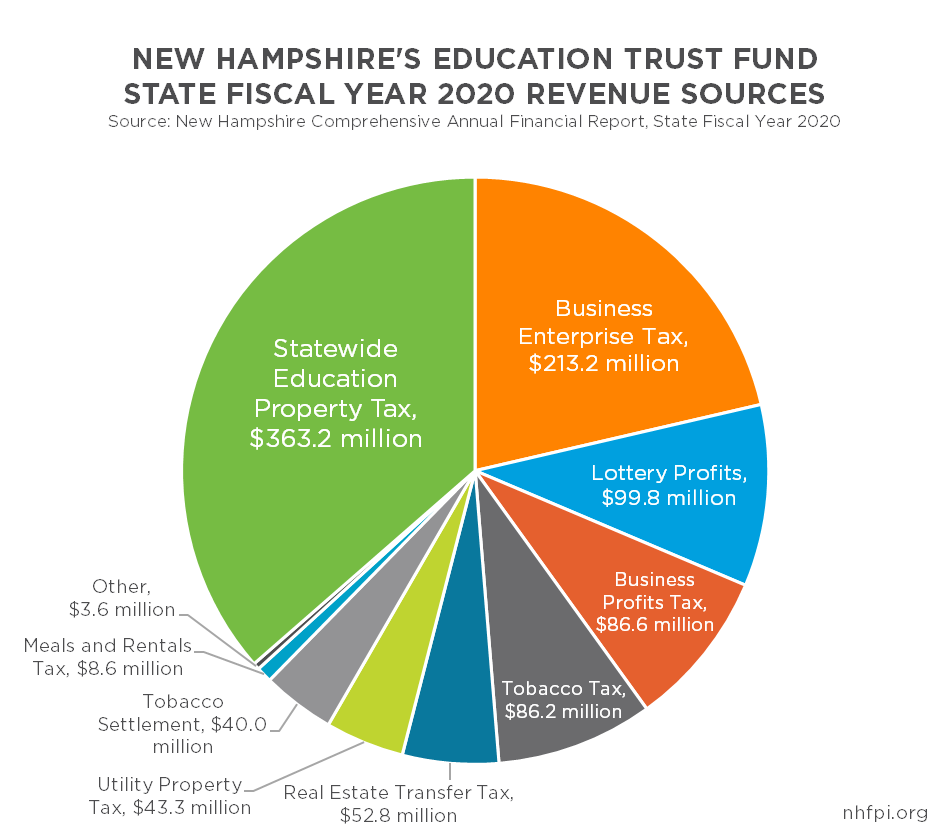

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

January 2014 Event Calendar Granite Restaurant Concord Nh Hotel Specials Easter Buffet Favorite Wine

Beef Tartar At Town Meeting Bistro Special Recipes Food Dinner Recipes

Atlanta Georgia Personal Chef Personal Chef Personal Chef Business Chef Craft

Nh Fiscal Policy Institute Holds Panel To Address Food Insecurity

New Hampshire State Agencies Project Major Revenue Declines Nh Business Review

Early Impacts Of The Covid 19 Crisis On State Revenues New Hampshire Fiscal Policy Institute

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Chat Game Logo Template Psd Vector Eps Ai Illustrator Tech Logos Logo Design Template Social Media Design Graphics

New Data Show Food Insecurity In New Hampshire Declined Pre Covid Nh Business Review